Jennifer Holowicki, of the MGH Office of the General Counsel with assistance from Lynn Afrow, recently updated social service and patient financial service staff on what we all need to know about Medicare D- the prescription drug coverage scheduled to begin January 1. Katy Kehoe, MPH, of Partners Community Benefit Programs is also ensuring that we have the information we need. I-cluded here is additional information and links she’s forwarded. We’ve written about this topic before, but think some of the information bears repeating, and there is some new information as well.

For those of you who have been following the developments in this program. Here’s what’s new.

As the new Medicare Handbook says in bold print “This year it’s different. Everyone needs to make a decision about Prescription Drug Coverage.”

For the first time, starting January 1, 2006, Medicare will cover most outpatient prescription drugs. Medicare is contracting with private companies to provide this drug coverage- known as Medicare Part D. There will be multiple insurance companies offering Medicare D in a given area. Members will need to choose one. One key criteria in making this choice will be the drugs covered (the “formulary”). The companies or “plans” must offer two medications in each category, but plans will differ in the specific drugs they cover. Formularies should be released on October 15. Another important concern is whether a specific pharmacy or chain participates in that plan.

In general, Medicare D is a voluntary program. Open enrollment starts soon and everyone on Medicare needs to make an informed decision about when and whether to apply. And this decision, or delaying a decision, has financial implications. There will be a financial penalty for “late enrollment” (see section below “Penalty for Late Enrollment” for details).

“Extra Help” is offered to those who qualify as having a low income and assets. This will cover some or all of the patient costs under the program. These applications were mailed out in July and August to those whose social security benefits indicate they might be eligible. But this will not reach everyone. Those who think they may qualify should apply.

Please follow this link for the list of companies who offer Medicare D coverage in Massachusetts (for other states you can start with this same list and scroll up or down) http://www.cms.hhs.gov/map/map.asp#MA. Starting October 13th, a tool for comparing plans will be available on-line at www.medicare.gov.

Standard Costs (For those not eligible for “Extra Help“)

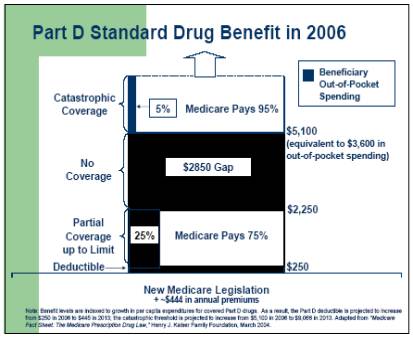

In 2006 Medicare D members will pay a monthly premium of about $32 (all of the specific dollar figures used in this section will increase each year). Members

then will have a deductible of $250 per year. After a member spends this first $250 on prescription medications, Medicare Part D will cover 75% of the cost of

covered drugs up to a Medicare pay-out of $1500. The member is responsible for a 25% co-pay for all drugs during this period. If a member’s drug costs in a year

exceed $2,250 (equivalent to member total cost of $750 + Medicare pay-ment of $1500), then the member is responsible for the entire cost of drugs up to a total drug

cost of $5,100 (or a member’s cost of $3,600 plus premiums). This is commonly known as the “donut hole” - where there is no coverage. If a member’s drug costs

exceed this threshold, “Catastrophic Coverage” kicks in. Medicare then covers drug costs above this level at 95% of the cost of the drugs, with no limit. See

accompanying diagram.

EXTRA HELP

Those with low income and assets, those who also receive Medicaid/MassHealth and some other special low-income Medicare programs are eligible for additional

assistance to cover some or all of the out-of-pocket costs described above. There are different levels of eligibility for “Dual Eligibles” and those who are non-Dual

Eligibles.

Extra Help for “Dual Eligibles”

Those who have both Medicare and Medicaid/MassHealth will automatically be enrolled in the “Extra Help” program. They will not pay a deductible, premiums or have a

“donut-hole”. They will only be responsible for co-pays of $1 per generic/$3 for brand-name drugs. These co-pays may still be a burden for many people. Unfortunately,

under this law, unlike the current MassHealth regulations, pharmacies are no longer required to fill prescriptions for those who cannot afford the co-pay. It is likely

that this will be an issue that legislative advocacy groups take up once there are real people who can’t afford the co-pays. If you have clients in this situation who

want to share their story, contact the CRC and we’ll connect you with such an advocacy group.

Extra Help for Non-Dual Eligibles

Those who have low income and low assets, but don’t qualify for Medicaid, may receive one of two levels of additional assistance, known as “Extra Help”. They must

complete an application to receive Extra Help. Please see the accompanying chart for the associated costs and benefits.

The application is available at: https://s044a90.ssa.gov/apps6z/i1020/main.html. Please note that this is just the application for “Extra Help”- it does not enroll a member in the Medicare D plan. That is a separate process that must also be completed.

Enrollment begins November 15, 2005. This initial open enrollment period ends May 15, 2006. Dual Eligibles will be automatically enrolled in a plan. They should receive a letter in October stating which plan they were assigned. They do not have to stay with this plan- they can simply call the company which they wish to join. If they state this preference before December 31, 2005 it should be effective on January 1, 2006. Dual Eligibles can change the plan with which they are enrolled at any time. Non-Dual Eligibles can change plans only during the open enrollment periods or in certain other limited circumstances.

For those not automatically enrolled, this is a voluntary program. However, there is a financial penalty for “late enrollment”. Late enrollment refers to enrolling after you are initially eligible, or after a significant gap in equivalent coverage. If one has a different plan that covers prescription drugs, as long as Medicare deems it equivalent coverage, then enrolling at a later date will not incur a penalty. Alternate plans should provide a letter that the plan is or is not considered equivalent. Members should keep this letter in a safe place, as this may be the only means of demonstrating equivalent coverage and avoiding a late penalty should they choose in the future to join Medicare D. Note that as of January 1, 2006, programs such as Medex Gold that provide prescription drug coverage will not be allowed to enroll new members. This rule is a means to include a wider pool of Medicare D members to help guarantee the program’s financial viability.

The penalty for late enrollment in Medicare D is a 1% premium increase for every month considered late, which is compounded monthly. This means that if one joins one year after first eligible, based on the current $32 monthly premium, the monthly premium including the late penalty would be at least $36.06; if one joins two years late it would be at least $40.63 a month, after 5 years $58.13, and 10 years $105.61, not accounting for yearly premium increases. So, Medicare recipients should carefully consider the costs/benefits of both enrolling and delaying enrollment. The average non-dual eligible will pay $384 in premiums in 2006. Added to the $250 deductible, this gives a break-even point of $634.

Prescription Advantage Members, MassHealth Members, those with Medex, those with employer-sponsored health insurance, those in federally subsidized housing, and other special circumstances should know about specific ways this program affects them.

Prescription Advantage members will be required to apply for Medicare D and the Extra Help. At this time the precise future of the Prescription Advantage program is unclear. It may become a secondary payor.

This SHINE fact sheet includes important information on what people with all the different types of Medicare and combinations with other insurance need to know: http://www.medicareoutreach.org/pdf2/Part%20D%20by%20beneficiary%20category.pdf.

Those who receive HUD housing assistance may be concerned about losing their housing subsidy if they apply for Extra Help paying for the new Medicare prescription drug plan. HUD housing subsidy recipients won’t lose eligibility for housing assistance, but their portion of the rent may be increased as their prescription drug spending decreases. Even with the increase in rent, the amount saved overall will be more than the increase. “No one will be worse off if he/she has the extra help paying for the Medicare prescription drug plan costs.” (From “Information Partners Can Use on: Housing Assistance From The Department Of Housing And Urban Development”, distributed by the US Department of Health and Human Services, 8/19/05). Recipients are not required to report your participation in the Medicare prescription drug plan program until the family’s next recertification. There is no need to report participation prior to that time.

The 2006 version of CMS's "Medicare and You" is now available online at http://www.medicare.gov/Publications/Search/Results.asp?PubID=10050&Type=PubID&Language=English . This publication is being mailed to all Medicare beneficiaries and contains a section on Medicare Prescription Drug Coverage. It is also being printed in Spanish.

09/05