Medicare Improvements Act

On July 15, 2008, Congress overrode President Bush’s veto and enacted the Medicare Improvements for Patients and Providers Act of 2008 (MIPPA). This law is perhaps best known for blocking scheduled cuts in Medicare’s payments to doctors. What is less understood is that MIPPA makes other important and positive changes to Medicare. Two key areas: include 1) improvements to Medicare benefits, especially for low-income beneficiaries; and 2) new policies to reduce racial and ethnic disparities among people with Medicare.

- Elimination of the Part D Late Enrollment Penalty for Low-Income Beneficiaries effective in January 2009:

Every year, since Part D began in 2006, to encourage enrollment Medicare has waived the late enrollment penalties for low-income beneficiaries. To ensure that this policy continues in the future, MIPPA permanently eliminates the Part D late enrollment penalty for low-income beneficiaries.

Most of the improvements become effective in 2010 or are phased-in starting that year.

- Asset Limits Increase for MEDICARE SAVINGS PROGRAMS* (Effective 2010)

Prior to MIPPA’s enactment, the federal asset limits for Medicare Savings Programs eligibility had been frozen since the programs began in the 1980s. The asset limits were stuck at $4,000 for an individual and $6,000 for a couple, and were not indexed for inflation. States have the flexibility under Medicaid to use more generous asset rules, and several states have done so. However, most states have not gone beyond the very low federal minimum. Under MIPPA, the federal asset limits for Medicare Savings Plans will be increased to the same level as the full Part D low-income subsidy and will be indexed to inflation thereafter. This change takes effect January 1, 2010. Although the actual Part D asset level for 2010 will not be announced until late 2009, the 2008 limit for the full subsidy is $7,790 for an individual and $12,440 for a couple.

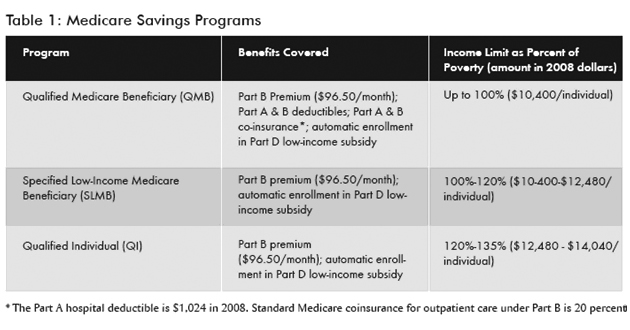

*What Are the Medicare Savings Programs?

Medicare Savings Programs are a family of three programs that provide assistance directly to low-income Medicare beneficiaries. The programs are: 1) Qualified Medicare Beneficiary (QMB); 2) Specified Low-Income Medicare Beneficiary (SLMB); and 3) Qualified Individual (QI). All three programs cover the cost of the Medicare Part B premium, which is currently $96.50/month. The QMB program also covers all other Medicare costsharing, including the Part A hospital deductible (currently $1,024) and Part B coinsurance (typically 20 percent for most doctor visits). Anyone who is enrolled in any Medicare Savings Program is also automatically qualified for the Part D low-income subsidy. Unfortunately, fewer than a third of those eligible are enrolled and receiving assistance. All three Medicare Savings Programs are administered through state Medicaid agencies as part of the Medicaid program. QMB and SLMB are jointly funded by states and the federal government. QI is entirely federally funded. Like other aspects of Medicaid, states have considerable flexibility in setting income and asset eligibility rules for all three Medicare Savings Plans, though many have stuck with the basic minimum federal eligibility rules. Table 1 provides a summary of the three programs.

In addition to allowing more seniors and people with disabilities to qualify for their state’s Medicare Savings Plans, this change should simplify the relationship between Medicare Savings Plans and the Part D low-income subsidy. Federal asset limits will be the same for all programs for beneficiaries with incomes up to 135 percent of the federal poverty level.

- Better Coordinated Outreach with Social Security

Currently, low-income beneficiaries who enroll in the Part D low-income subsidy through the Social Security Administration are not screened for eligibility for Medicare Savings Programs. As a result, there may be many low-income beneficiaries receiving the low-income subsidy who are eligible for, but not enrolled in, a Medicare Savings Program to help with other Medicare costs. MIPPA takes several steps to address this problem. Starting in 2010, Social Security will transmit data about low-income subsidy applicants to states. States will be required to act on the data to determine if the applicant is also eligible for a Medicare Savings Program. In addition, Social Security will be required to provide additional information about Medicare Savings Programs to applicants, and Social Security staff will receive additional training about Medicare Savings Programs.

Additional Improvements to the Part D Low-Income Subsidy

- Life Insurance Eliminated as a Countable Asset, Effective January 2010

Currently, the asset test for the Part D low-income subsidy includes the cash value of an applicant’s life insurance as a countable asset. This provision creates hassle for applicants, who must contact their life insurance company to determine their policy’s cash value, if any. Beneficiaries may also be disqualified because the cash value of their policy puts them over the asset limit. Effective January 2010, this provision will be eliminated.

- In-Kind Support and Maintenance Eliminated as Countable Income, Effective January 2010

Currently, low-income subsidy applicants must estimate the value of in-kind support they receive, such as groceries paid for by an adult child. This question is seen as intrusive by many applicants and discourages completion of an application. Starting in January 2010, this question will be eliminated.

Other Medicare Benefits Improvements

Currently, Medicare beneficiaries must pay coinsurance of 50 percent for outpatient mental health services. This is substantially more than the 20 percent they pay for most other outpatient medical care. MIPPA will gradually correct this inequity by phasing coinsurance rates for mental health services down to 20 percent by 2014.

- Benzodiazepines and Barbiturates Covered by Part D, Effective January 2013

Currently, Part D does not cover benzodiazepines and barbiturates. Effective January 2013,Part D plans will be allowed to cover benzodiazepines, and barbiturates under certain conditions.

- Addressing Health Disparities

Communities of color account for over 20 percent of Medicare beneficiaries. Although Medicare covers nearly all individuals over age 65 with the same standard benefits, numerous studies have shown that people of color do not always fare as well under the program. As the single largest purchaser of health care in the United States, Medicare has tremendous potential to reduce racial and ethnic disparities in health. MIPPA will seek to address health and health care disparities in the Medicare program via:

- Improved Data Collection for Measuring and Evaluating Health Disparities

- Outreach to the Previously Uninsured

- Compliance with Cultural Competency Standards (primarily regarding language access).

To view the full text of the Medicare Improvements for Patients and Providers Act (MIPPA), PL 110-275, go to www.govtrack.us/congress/billtext.xpd?bill=h110-6331.

-Adapted from: “ Congress Delivers Help to People with Medicare: An Overview of the Medicare Improvements for Patients and Providers Act of 2008 ” Issue Brief, Families USA October 2008 , at http://www.familiesusa.org/assets/pdfs/medicare-improvements-act-2008.pdf, retrieved 12/8/08.

12/08